Financial Literacy Is The Solution

Q: How did you start?

A: I always wanted to give back to society for what I have received. I had dreams and targets and I was lucky to accomplish most of them during the journey. I needed to find something that I am passionate about - something that would touch millions and would change their lives.

Having this in my mind, one day it just happened! On my way to a meeting in the summer of 2009, I was reading The Economist on a flight. The picture of an Afghan man with a child bride deeply hurt me. I wanted to change the fate of the child. Not only that one but many others who suffer; to cope with what life has dealt them.

There should have been a solution. There should be something to change the injustice. And there should be something that I could do instead of just feeling hurt. My answer was very clear. Economic freedom is the solution to have the power to change one’s dreams. That can only be achieved by financial literacy.

Q: What were the major obstacles to overcome?

A: In society, there are very strict traditions about money issues, especially if it is about your personal financial needs and situation. I needed to start by convincing the individuals to talk about money. Yet whoever I shared my mission with came with the same resistance: people will not talk about money openly. They will never state how much they earn and what their debts are. We needed to start somewhere, and I strongly believed that we needed to reach millions. Therefore, we started with a TV program about personal finance. It was a tough job to convince the TV channels. But as it started, millions started telling me all about their financial lives on air LIVE!

Q: Did you have a mentor or a role model?

A: I believe success stories are built upon inspiration and belief. This can be achieved by curiosity based on facts. Therefore, I read everything that I could find about personal finance psychology, neuro-economics, behavioral finance and the history of money. My team and I investigated the international models. I was also lucky to have a supportive boss, Mr. Şahenk, the Chairman of Doğuş Group, who made it possible for me to pursue my dream. First of all, I was allowed to devote time to my passion and felt his full support, because he also believed on the cause that financial literacy will change the destiny of others.

Q: How did you learn from failure?

A: Life is a learning journey. Failures are actually our motivation to restart and are a learning process. So if I spend a day without learning that will be failure to me. I failed several times, especially regarding my digital initiatives.

Q: What has been your biggest lesson so far?

A: There is no such thing as a small change. Change has a snowball effect. As we change the meaning of money for individuals, it will not only change their life, but also the future of their nations. One’s relationship with money is an expression of one’s self values, principles, discipline, psychology, and spirit. And that can change!

Q: What would you have done differently?

A: Trust my instincts even more…

Q: How can we help more women become entrepreneurs or claim higher board positions?

A: Inspire. Open roads for equal opportunity. Invite them to networks. Sponsor them. Work with men for solutions.

Q: What is one piece of advice you would give to an aspiring entrepreneur?

A: Think without limits. Like Neo in the movie Matrix.

Q: What is FODER’s mission?

A: Financial Literacy and Inclusion Association is a non-profit organization which aims to increase the percentage of financially literate people and raise awareness on financial inclusion in Turkey. It works in cooperation with many governmental agencies, private entities and other NGOs. Another aim of FODER is to support the creation of the necessary eco-system for financial literacy in Turkey.

Q: Share with us some success stories of women involved with FODER.

A: As I travelled throughout Anatolia for a Financial Literacy education session, I met a woman in her 40s with two kids. After the session, I learned that she was following my educational courses, newspaper articles and never misses my TV program (Para Durumu) and while doing so, she learned how she could manage the money that she earned. She got into the business life by getting micro credits to raise her kids better, to give them a good education and a peaceful retirement. She earns her living in a self-opened little diner where she cooks homemade meals for her customers. Even though she says that she gets tired from time to time, earning her money all by herself is worth all of it.

Although courageously getting into business life, being a woman in a small mining town called Soma, business terrified her at the beginning, but you could see the pride of the success that came afterwards in her eyes. She says that her husband had some concerns, but after she continued her business with great profits and proved herself, he gave her his full support. To touch women in a way that they are able to stand on their feet, to be able to see the tangible effects of affecting the lives of their families and other individuals gives me great pleasure.

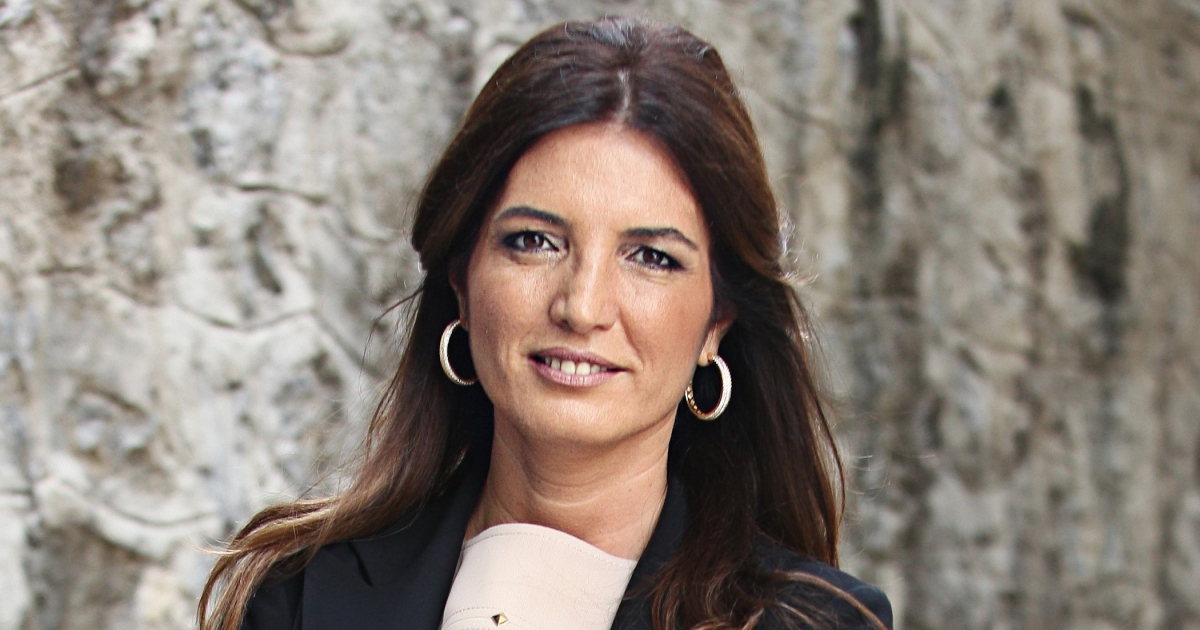

Özlem Denizmen

Founder Chairman, FODER (Financial Literacy and Inclusion Association)

Ozlem Denizmen is a prominent opinion leader regarding women's empowerment in Turkey. She is also committed to spreading financial literacy with afocus on inclusion and entrepreneurship. Passionate about these topics, she holds many roles, from social entrepreneurship, management positions to board, committee and community memberships. She is the first Turkish national chosen to become a Board Member at the Global Reporting Initiative (GRI) and was chosen as a “White House Delegate” at OBAMA’ s Presidential Summit on Entrepreneurship in 2010 and as a "Young Global Leader’‘ in the 2011 World Economic Forum . Ozlem is also a member of Cornell University's “President’s Council of Cornell Women”. Since Febuary 2016 , she is also a member of Advisory Board at Girls 20.

In 2010, Ozlem launched ‘Para Durumu’, a multi-media platform that reaches out to millions with the aim of increasing financial literacy in Turkey, and since 2013, she acts as the Founding Chairman of the Financial Literacy and Inclusion Association (FODER).

Denizmen completed her B.A. at Cornell University (1994) in Industrial Management and her MBA at MIT Sloan School of Management (1999). She also completed in executive education programs such as “Negotiation” at Stanford (2004), ”Business Leadership” at GE Crontonville (2006) and “Advanced Management Program” at Harvard Business School (2008). “Global Leadership and Public Policy for the 21st Century” program at Harvard Kennedy School (2013).

Published: 10/04/2017